Weekly TLDR - Big Tech Earnings

In this week’s TLDR, we talk about the unraveling of US-China relations, another tech earnings lightning round, and Robinhood’s massive layoff.

The TLDR

In this week’s TLDR, we discuss the unraveling of US-China relations, tech earnings, and Robinhood’s massive layoff.

US-China Edition

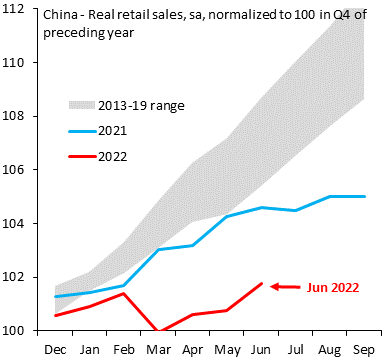

Speaker Pelosi’s visit to Taiwan is highlighting tensions between the US and China. The stakes couldn’t be higher as China’s GDP grinds to a halt with a mere 0.4% increase in Q2. Without strong economic growth supporting domestic sentiment, the Chinese government needs to either re-kindle growth or shift attention elsewhere.

Speaking of rekindling economic growth, China’s recent moves to establish the renminbi as a potential global reserve currency and its tacit diplomatic avoidance of the Eastern European conflict are long-term geopolitical investments in heightening China’s global role. However, long-term investments won’t resolve the short-term issues of slowing consumer spending, declining home prices, a poor pandemic response, and a spate of anti-business regulations against some of the country’s own internet companies.

The convenient short-term distraction for brewing domestic concerns is Taiwan. The geopolitical saber-rattling on both sides can paper over troubles at home but an actual kinetic conflict comes at great cost to the world and benefits nobody. This is ultimately a game of “who needs who more” and the ones to suffer first will be the people and companies stuck in between (e.g. US and Chinese companies with businesses in opposing countries).

The TikTok Factor

We have written in the past about the risks associated with US-listed Chinese companies so we won’t go in-depth about these risks here but the emergence of TikTok makes it a huge target in the US by both industry competitors and regulators. Alphabet and Meta likely have lobbyists working around the clock to bring TikTok to the forefront of national security conversations. A ban or forced divestiture of TikTok would be a market shaking event. The app has grown considerably during the pandemic and is now materially threatening the businesses of both Alphabet and Meta. Unfortunately, it still appears to be far from being run independently of its parent company Douyin. Any large US company is chomping at the bits to acquire TikTok, particularly those without an existing social media footprint like Microsoft, Amazon, or Apple. If a TikTok ban or divestiture does occur, China will retaliate with bans of their own. There are a slew of US companies with massive businesses in China that could be swiftly banned. This will significantly hurt the US financial sector and economy. As such, we think that a TikTok ban is unlikely to happen.

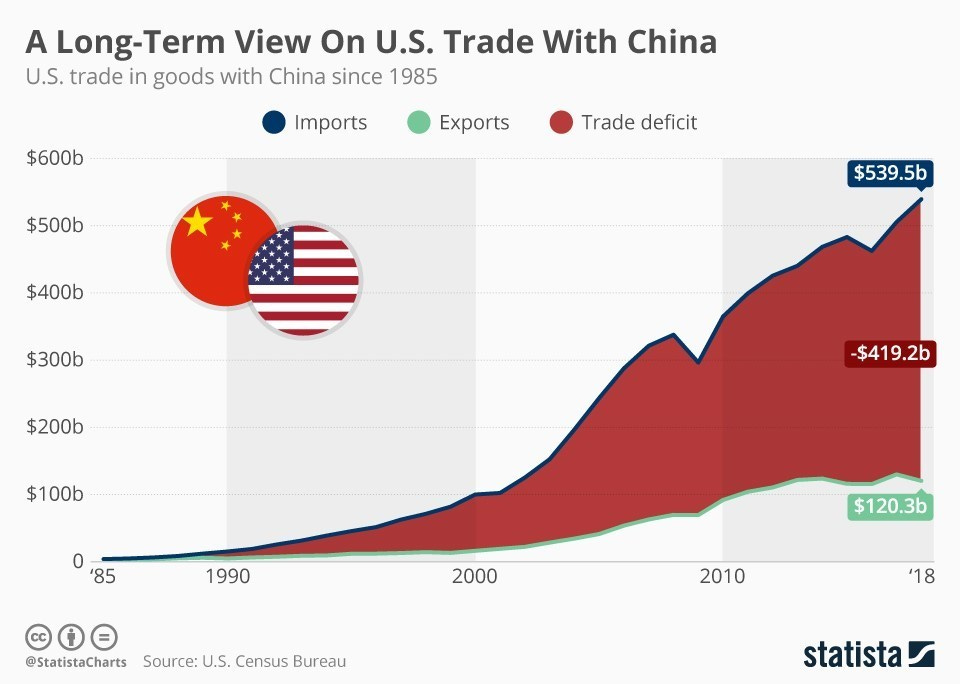

A Painful Breakup

A fraying relationship between the US and China is unravelling the world’s largest trade partnership. Both countries are now aggressively onshoring supply chains and manufacturing capabilities. For example, the passing of the CHIPS Act by Congress is a sign of the US promoting its internal semiconductor industry and de-risking from Southeast Asia’s semiconductor industry. US and China’s economies are so intertwined that the process of economic decoupling is long and painful but seemingly unavoidable at this point.

This macroeconomic sea change will create all sorts of opportunities that we are just scratching the surface on. We will continue to share news and analysis, pertaining to the markets, as the situation develops.

Stock Market TLDR

Earnings Lightning Round

Amazon: Results - Revenue Beat / Earnings Miss / Good Q3 Outlook

Meta: Results - Revenue Miss / Earnings Miss / Bad Q3 Outlook

Apple: Results - Revenue Beat / Earnings Beat

Microsoft: Results - Revenue Miss / Earnings Miss

Alphabet: Results - Revenue Miss / Earnings Miss

Uber: Results - Revenue Beat / Earnings Beat

Pinterest: Results - Revenue Miss / Earnings Miss / Users Beat

Intel: Results - Revenue Miss / Earnings Miss / Bad Q3 Outlook

AMD: Results - Revenue Beat / Earnings Beat / Bad Q3 Outlook

Amazon’s Q2 Earnings (+13% in after hours trading)

Amazon’s earnings results were well received by the market. Even as the company struggled with rising costs due to inflation and supply chain pressures (thus missing earnings expectations), there is much to celebrate in other aspects of the business.

The company’s crown jewel division, AWS, continued to grow faster than expected while its nascent Ads division also outperformed expectations by growing 18% year-over-year. The strength of Amazon’s Ads business this quarter is remarkable given the troubles that the rest of the ads industry experienced this year.

Finally, the company surprised the market by providing upbeat guidance for the third quarter.

Meta’s Q2 Earnings (-3.8% in after hours trading)

Meta missed on both revenue and earnings expectations. The company reported its first ever year-over-year quarterly revenue decline. Q2 revenue fell almost 1% from a year earlier.

Among its big tech peers, Meta is experiencing unique challenges. Although everyone is being buffeted by macroeconomic headwinds, Meta’s primary business is social media and thus has to contend with TikTok, a formidable upstart that’s cutting into both engagement and profitability of Meta’s apps. Meta’s counter to TikTok is Instagram Reels but Reels doesn’t monetize as well as Feed and Stories (bread-and-butter ad surfaces for the company).

Meta is also investing heavily in its metaverse-focused Reality Labs business unit. This is a long-term bet with many unknown unknowns; two properties that the market generally shies away from. Reality Labs brought in $452 million this quarter but lost $2.8 billion. FinanceTLDR is bullish on Reality Labs but it’ll be a long and painful process before Reality Labs can materially transform Meta’s business.

Meta forecasts another year-over-year quarterly revenue decline in Q3.

Apple’s Q2 Earnings (+3% in after hours trading)

Apple met revenue expectations and exceeded earnings expectations.

Here’s a good revenue breakdown across its various product categories (source: CNBC):

iPhone revenue: $40.67 billion vs. $38.33 billion estimated, up 3% year-over-year

Services revenue: $19.60 billion vs. $19.70 billion estimated, up 12% year-over-year

Other Products revenue: $8.08 billion vs. $8.86 billion estimated, down 8% year-over-year

Mac revenue: $7.38 billion vs. $8.70 billion estimated, down 10% year-over-year

iPad revenue: $7.22 billion vs. $6.94 billion estimated, down 2% year-over-year

The company said that inflation is increasing costs and it even lost $4 billion of revenue this quarter as a result of parts shortages (estimated at $4 to $8 billion in Q1). Apple’s revenue from Greater China fell 1% on an annual basis to $14.6 billion. Apple blamed this on pandemic restrictions that hurt demand. 18% of this quarter’s revenue came from Greater China and the elephant in the room is escalating US-China tensions. If the geopolitical situation worsens, this revenue could vanish overnight.

Microsoft’s Q2 Earnings (+5% in after hours trading)

Microsoft’s earnings results were Bad But Not That Bad. The company missed on both revenue and earnings, yet its share price rose in after hours trading.

The primary causes of missed expectations are a strong US dollar affecting international sales (reduced revenue by $595 million), weak overall advertising demand (reduced revenue by $100 million), and weak computer sales from consumer spending shifting to services rather than goods (reduced revenue by $300 million). Azure also didn’t grow as fast as expected.

Amidst the bad news is one morsel of good news that the market took and ran with. Despite the rough economic climate, Microsoft stood by its full-year forecast that was shared in Q1.

Alphabet (+4% in after hours trading)

Alphabet missed on both revenue and earnings expectations. This is yet another case of Bad But Not That Bad as the stock was bought up in after hours trading.

The big takeaways from the earnings results is YouTube and Google Cloud missing advertising revenue expectations and a strong dollar knocking “3.7 percentage points off revenue growth”. YouTube’s troubles are the result of a contracting ad industry and rising competition from TikTok.

One interesting stat from this earnings report is that the company’s Other Bets business segment (containing Waymo, health-tech projects, and its venture arm) saw revenue increase by $1 million year-over-year to $193 million. To make this revenue, it cost the business segment $1.69 billion.

Crypto TLDR

MicroStrategy Pivots Strategy

The Short: MicroStrategy’s eccentric CEO Michael Saylor is stepping down from the job and taking on a new role of executive chairman. He will continue to focus on the company’s Bitcoin investments and advocacy initiatives.

The Long: Michael Saylor is an eccentric Bitcoin bull that also happens to be the founder and former-CEO of a multibillion-dollar software company. Over the pandemic, he turned his software company, MicroStrategy, into a makeshift Bitcoin ETF. The company invested billions of dollars into Bitcoin and even took on a $200 million+ loan from Silvergate Bank to buy more Bitcoin. At the same time, Saylor was all over financial media evangelizing Bitcoin and his company’s unique investment strategy.

As the crypto market crashed, so has Saylor’s reputation. This is likely a major impetus for Saylor stepping down. He seems way more interested in Bitcoin than actually running his company. In his new position, Saylor will still be overseeing MicroStrategy’s Bitcoin investments while Phong Le, previously the company’s president, will take over as CEO.

Another Robinhood Layoff

The Short: After Robinhood reported Q2 earnings, the company announced that it’s laying off almost a quarter of its full-time employees (23% of staff, or over 700 employees).

The Long: A significant portion of Robinhood’s revenue comes from trading volume. The higher the trading volume on its platform, the more revenue Robinhood pulls in. With stocks and options trading, it makes money through Payment for Order Flow (PFOF). With crypto trading, it makes money through commissions. Unfortunately, interest in stocks and crypto trading crashed when both markets experienced significant drawdowns over the last two quarters. This has stymied Robinhood’s growth and put significant pressure on both its top and bottom lines. The company, like many others that rode pandemic highs, initially projected 2022’s growth rate to be similar to 2020 and 2021’s and thus hired aggressively based on this projection. Needless to say, 2022 has been a huge disappointment, with many companies finding growth this year to be muted or even negative! As a result, most have started cutting costs and this often involved trimming headcount.

This layoff is Robinhood’s second of the year. Just three months ago, the company laid off 9% of its full-time staff.

Another Massive Crypto Hack

The Short: The cross-chain bridge Nomad was exploited two days ago and drained of $190 million. A cross-chain bridge is a crypto system that enables the transfer and trading of assets between different blockchains.

The Long: Cross-chain bridges are incredibly complex systems since they need to securely and reliably connect across multiple disparate blockchains. Complexity increases the chances of bugs and vulnerabilities. In addition, to facilitate the transfer and trading of assets between different blockchains, a cross-chain bridge needs to hold a significant amount of assets on its “books”. In this way, anyone that wants to make a transfer or trade can immediately do so. Put together, these properties make cross-chain bridges the perfect target for hackers to exploit and plunder unimaginable amounts of money. The hackers that successfully broke into Nomad were able to withdraw $190 million!

2021 has not been a great year for cross-chain bridges. In March of this year, Ronin Bridge was hacked and drained of over $600 million in the largest ever DeFi hack to date. Ronin Bridge powered the popular NFT game, Axle Infinity. Just a few months before that, hackers siphoned $300 million from Solana’s Wormhole bridge.