Weekly TLDR - Netflix's Warning

In this week’s TLDR, we talk about Amazon’s profitability, a bad market forecast, Netflix’s earnings, and Ethereum’s massive comeback.

The TLDR

In this week’s TLDR, we talk about Amazon’s profitability, a bad market forecast, Netflix’s Q2 earnings report, and Ethereum’s massive comeback.

Chart of the Week

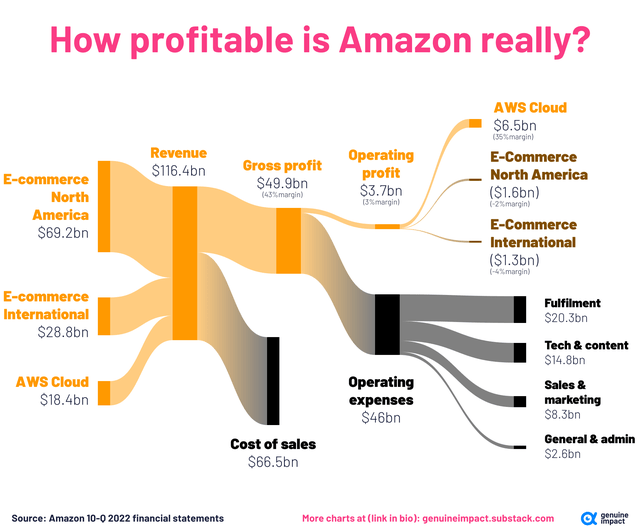

Amazon generates a stupendous amount of revenue. Last year, it brought in almost $470 billion at the top line!

But how much does it get to keep at the end of the day? This chart below is a good way to visualize how the money flows.

Amazon is an interesting case of two disparate businesses mish mashed together. The businesses’s stark difference is exemplified by their orthogonal income statements. AWS contributes a small part to overall revenue but represents the lion’s share of overall profit. Retail generates most of Amazon’s revenue yet its profit is paltry.

In a way, Amazon’s internal dichotomy is a microcosm of the US economy. There’s a group of generally young companies (e.g. tech companies) earning exorbitant margins with minimal capital expenditures (lots of outsourcing) alongside “old economy” companies earning low margins with high capital expenditures (maintaining factories, warehouses, transportation fleets, etc.).

Stock Market TLDR

A Bad Forecast (At Least For Now)

The Short: In the Market Forecast issue sent out on Monday, my prediction was that stocks will fall in the short-term. In the past two days, the market has defied this forecast and roared upwards. Needless to say, forecasting markets is hard, especially in such volatile times when the global economy is on edge.

The Long: The thesis for the forecast was that poor Q2 earnings results will push stocks lower, yet the market seems to be shrugging off concerns about earnings and relentlessly marching upwards. Perhaps the market is rallying on falling inflation expectations, which are at their lowest point in more than 10 years. As is often the case, the impetus for ongoing market movements is unclear. More retrospection is required.

The forecast is off to a bad start but it’s important to keep in mind that the recent rally could easily reverse and the prediction of a short-term fall in stocks is eventually correct.

Netflix’s Warning

The Short: Netflix hosted its Q2 earnings call yesterday and said something that’s likely to become the theme of this earnings season. The company warned that a strengthening US dollar is putting pressure on both its top and bottom lines. The dollar’s recent volatility is also the primary reason for the large variance in their revenue guidance.

The Long: In the most recent FinanceTLDR issue, I wrote that a soaring US dollar is wreaking havoc in the developing world. It’s also causing problems with the international businesses of many US companies. US companies make money abroad in foreign currencies but report international finances in US dollars. As such, a strong dollar reduces international cash flows.

This puts downwards pressure on affected US companies’s earnings results and is overall bearish for US stocks. A large chunk of the S&P500 by market cap makes money abroad through services (* cough * large tech companies * cough *) and can’t take advantage of a strong US dollar for cheap imports.

In addition, in our globalized world, the scale of the international businesses of many large US companies are non-trivial. For example, Apple generates two thirds of its revenue from non-US sources!

At Least It Wasn’t That Bad!

The Short: Back to Netflix’s Q2 earnings. They reported yesterday and it was well received by the market. Expectations for catastrophe were met with only a minor disaster. Phew!

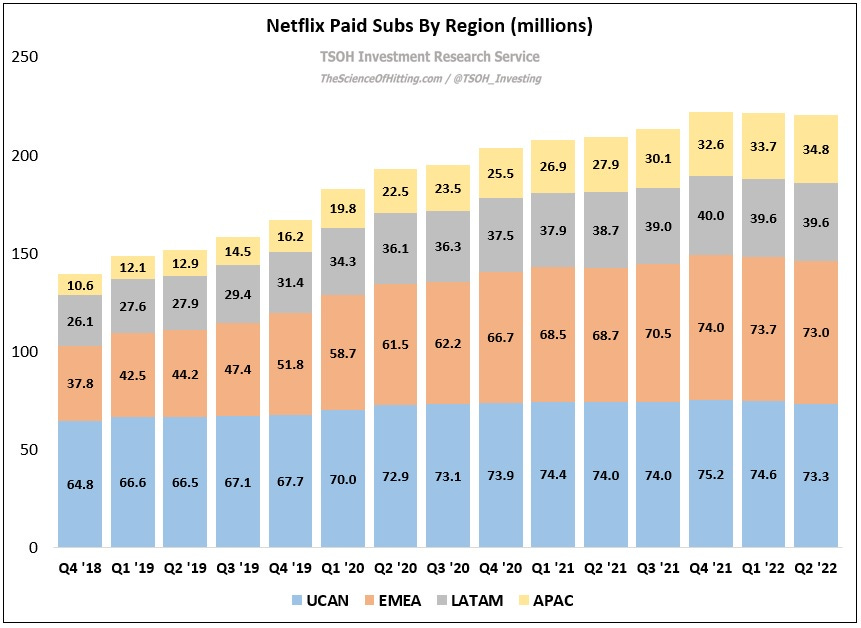

The Long: The most important number in Netflix’s earnings is their subscriber count. The company forecasted a massive drop of 2 million subscribers for Q2 but subscribers only fell by 970,000. This was “less bad” enough for the market to gobble up the stock.

The results were bad, but at least it wasn’t that bad!

It’s still worrisome that despite the release of the new season of the most popular English show on the platform, Stranger Things, the company wasn’t able to at least maintain subscriber numbers. It’s unclear whether this release was factored into the dire Q2 forecast of a net loss of 2 million subscribers.

The positive reaction to Netflix’s earnings is yet another example of how the market is driven by expectations and not by the absolute state of things.

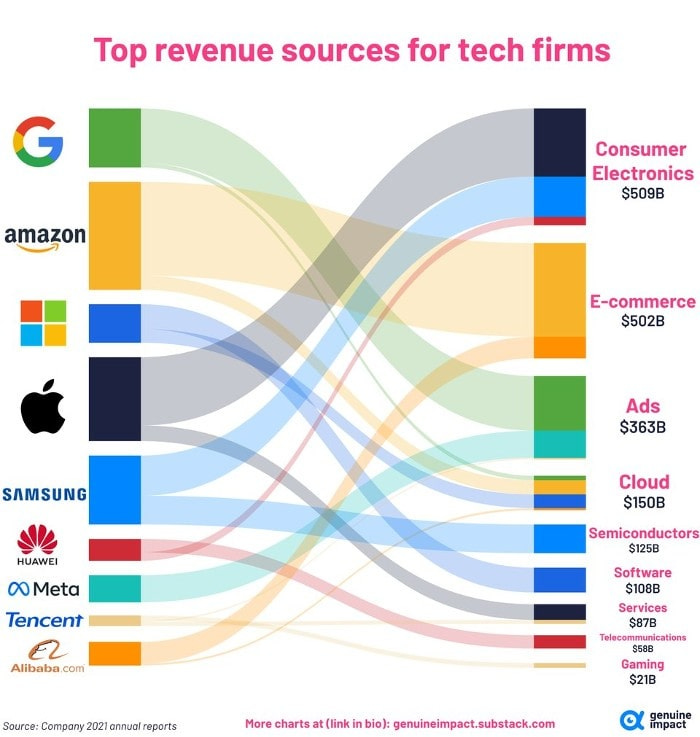

Where Do Large Tech Companies Make Money?

Before I move on to crypto news, here’s a great chart of where large tech companies make their money across major business categories. We all have implicit understandings of their businesses but it’s still insightful to visualize their revenue breakdowns.

Crypto TLDR

Ethereum’s Massive Comeback

The Short: The crypto market is currently staging a massive comeback with Ethereum leading the pack. While Bitcoin gained almost 20% in the last week, Ethereum gained more than 40%. This is likely happening on the back of anticipation for the upcoming Ethereum 2.0 upgrade slated for September.

The Long: Ethereum’s recent comeback is impressive, and it signals excitement and confidence in the upcoming Ethereum 2.0 upgrade that’s expected to happen in September. Although the upgrade has been pushed back a few times, all signs point to a September merge (e.g. several major test nets have already undergone the process successfully). Post-merge, Ethereum will be a full Proof of Stake blockchain with minimal greenhouse gas emissions and significant scalability. There will be fewer periods, perhaps none, where congestion makes the blockchain absurdly expensive to use. Some market participants even expect Ethereum to “flip” Bitcoin after the merge and become the largest cryptocurrency by market cap.

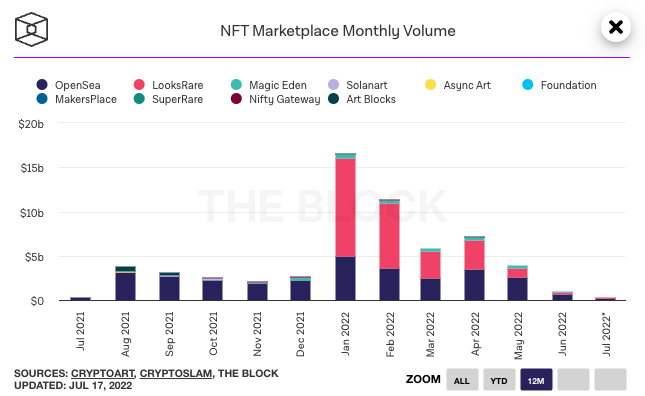

Not Looking Good for NFTs

Let’s end this issue with a peek at the state of the NFT market. Interest in NFTs have cratered with the crash of the crypto market. Bear markets have a tendency to bring clarity back into the heads of market participants.

That is not to say that this wacky new asset class won’t make a resurgence in future crypto bull markets, but it certainly got way ahead of itself at the peak. The bygone irrational exuberance for NFTs is exemplified by the asset class’s largest startup, OpenSea, which raised $300 million late last year. This valued the company at $13.3 billion, almost 10x its $1.5 billion valuation a few months ago in July!